A Guide to Creating Personalized Digital Services in Insurance

Learn how to leverage the power of AI and Advanced Analytics to manage changing customer expectations – and thrive in the digital age.

Deliver a contextual 360° view of every party and risk, helping you uncover hidden behavioural connections that accelerates data modernization.

Turn insight into action that uncovers distribution opportunities, automates underwriting & claims assessment and deepens customer relationships .

Drive profitable growth by improving quote-to-bind conversion up to 50%, whilst reducing loss & expense ratios by up to 3%.

Automate risk-segmentation decisioning to stop leakage, prevent fraud and deliver indemnity savings—improving loss ratios by 1–3%.

Boost account density accuracy by up to 60% and sales efficiency by up to 90%, while improving retention and reducing churn by identifying at‑risk customers earlier.

Deliver trusted straight-through claims and low-touch underwriting through a holistic view of customer segmentation, risk propensity, fraud, and recoveries.

Proactive 360-degree monitoring of the portfolio to prevent fraud, reduce ESG exposure and strengthen automated KYC, sanctions and supply-chain defences.

Build a 360 view of customer and producer to identify new markets to enter, uncover cross-sell opportunities faster and distribute smarter in omni-channel environments.

Unify historical insights against submissions to assess them faster against risk appetite & pre-underwrite new customers with lower friction to maximize intake capacity.

Streamline claims through a connected 360 view of parties, improving claim segmentation and customer experience while reducing leakage, litigation and subrogation risk.

Deliver a holistic view of the portfolio to increase the speed & accuracy of perpetual underwriting & improve portfolio risk assessment across all lines of business.

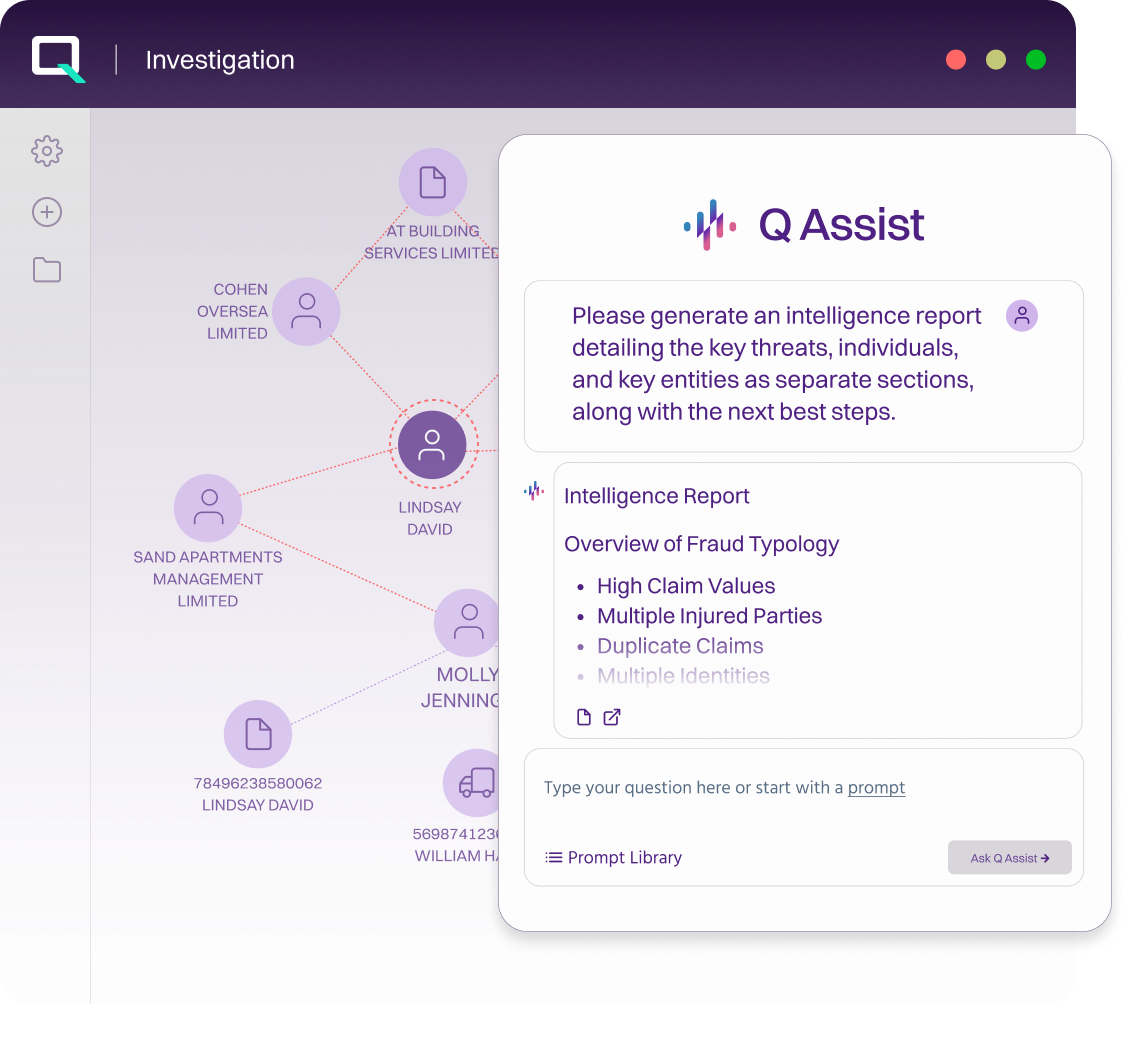

Increase the sophistication of your threat defenses through a unified view of risk with enhanced contextual fraud detection & robust financial crime investigation solutions.

Purpose-built for insurance, our platform is designed to integrate with existing workflows and deliver faster time-to-value across the organization.

loss ratio improvement

of underwriting work automated pre-submission receipt.

increase in cross-sell income per annum.

improvement in accuracy of single customer/broker/channel performance view.

reduction in false positives, enhancing STP and NPS scores.

How the complex insurance landscape and poor-quality data is affecting growth

The new opportunities and proven strategies for growth

Ways that contextual data, analytics, and AI accelerate profitable growth and improve customer experiences

A framework for decision intelligence success to achieve measurable results

Create a unified, automated view of every policyholder, application and first party across all products, brands and regions. Identify churn risks, deliver personalized cross-sell offers and optimize customer experience at every stage of the lifecycle.

Eliminate data silos and build a trusted, connected view across internal and external sources. Resolve incomplete or low-quality data in real time to reveal accurate relationships and hierarchies — powering multiple use cases across the enterprise.

50%Improvement in quotability and conversion

70%Improvement in fraud impact

30xFaster customer profiling and risk assessment across underwriting

80%Reduction in complex case handling

Yes — and you should. CRMs are great for engagement, but they weren’t built for insurance decisioning. Quantexa adds the intelligence layer that turns your CRM into a growth engine for underwriting and distribution.

Definitely. Access isn’t the issue. Fragmentation is. We unify your data using real-time entity resolution and graph analytics to give you a connected, contextual view across your business.

You start with a unified foundation. Our decisioning framework adapts to different products and jurisdictions, while keeping logic consistent and auditable. Smart decisions, everywhere.

You automate the insight. Quantexa reveals whitespace and product density opportunities using graph analytics — no spreadsheets, no guesswork, just timely, targeted growth.

Layer intelligence on top. We plug into your existing systems and accelerate triage, risk selection and decisioning with AI — no disruption, just better outcomes.

Make every decision count. With Quantexa, you’ll see the metrics move: faster time-to-quote, higher product density, better loss ratios and stronger channel performance.

Quantexa connects siloed data to create a contextual 360° view of customers, households, and businesses. This enables insurers to identify cross-sell and upsell opportunities, personalize offerings, and improve customer retention.

By uncovering hidden relationships and networks, Quantexa enhances risk assessment beyond traditional data. This allows for dynamic risk scoring, competitive pricing for low-risk customers, and reduced exposure to high-risk entities.

Quantexa uses AI and graph analytics to detect hidden fraud patterns, assess claims in context, and reduce leakage through automated anomaly detection. This strengthens controls while speeding up genuine claims.

Quantexa unifies data across underwriting, claims, and distribution, creating a single source of truth. Combined with AI-driven automation, this reduces manual effort and improves efficiency across the enterprise.